🔥 The Largest Upward Transfer of Wealth in American History: How House Republicans Just Robbed the Poor to Pay the Rich

How $389,280 annual windfalls for the ultra-wealthy will be paid for by families losing food and healthcare. Breaking down the largest legislative wealth transfer in American history.

😽 Keepin’ It Simple Summary for Younger Readers

👧🏾✊🏾👦🏾

House Republicans just passed a massive bill that gives huge tax breaks to millionaires and billionaires while cutting programs that help families afford food and healthcare. The richest Americans will get hundreds of thousands of dollars in extra income each year, while working families will lose money and services they depend on. It's like taking lunch money from kids to buy luxury cars for their teachers' bosses. Policy experts say this is the biggest transfer of wealth from poor people to rich people in American history, but communities are fighting back through organizing, voting, and taking care of each other.

🗝️ Takeaways

💰 House Republicans passed a $2.5 trillion tax cut package that primarily benefits the wealthy while cutting food and healthcare for millions

📊 The top 0.1% of earners will gain nearly $390,000 annually while families earning under $10,000 see income drop by 14.9%

🏥 7.6 to 15 million Americans could lose health insurance through $700 billion in Medicaid cuts

🍽️ $267 billion in SNAP cuts will affect over 42 million Americans who rely on food assistance

🏜️ Borderlands and indigenous communities face double jeopardy from environmental racism and economic extraction

📈 The bill adds $3 trillion to the federal deficit, essentially borrowing money to give tax cuts to billionaires

⚖️ Policy experts call this the largest single legislative transfer of wealth from poor to rich in U.S. history

💪 Resistance strategies include voter registration, mutual aid, supporting local organizations, and building alternative economic systems

How House Republicans Just Robbed the Poor to Pay the Rich

Here in the borderlands of Southern Arizona, where the desert doesn't care about your politics and the saguaros have witnessed more honest governance than most of Washington D.C., we're watching the latest chapter in America's ongoing experiment with legalized theft.

On May 22, 2025, House Republicans worked through the night to advance what policy experts are calling the largest upward transfer of wealth in American history—a "big, beautiful bill" that would make Robin Hood weep and the Sheriff of Nottingham applaud.

But let me back up, because if you're like most working families trying to keep your head above water while billionaires play space cowboys, you might be wondering: what exactly just happened, and how badly is it going to hurt?

What Just Happened: A Heist in Plain Sight

House Republicans passed a massive reconciliation bill by a razor-thin margin of 215-214, combining $2.5 trillion in tax cuts for the wealthy with brutal cuts to programs that keep millions of Americans fed, housed, and healthy. The Congressional Budget Office hasn't even had time to calculate the full devastation—how many millions will lose health insurance, by how many trillions the deficit will explode—because Republicans rushed this through faster than a coyote crossing the border at midnight.

Qué ironía, right? The same party that spent years screaming about fiscal responsibility just voted to blow a $3 trillion hole in the federal budget to line the pockets of their donors.

According to the CBO analysis referenced in multiple reports, this legislation would fundamentally redistribute resources from the poorest Americans to the wealthiest.

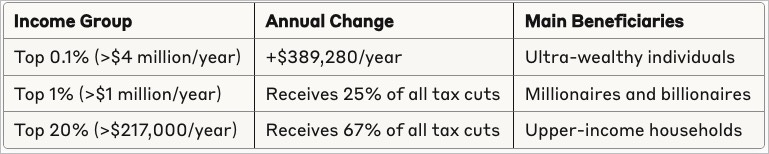

The numbers are staggering: nearly two-thirds of the $2.5 trillion in additional tax cuts will flow to the top 20% of earners, with one-fourth benefiting just the top 1%.

The Devil in the Details: Who Wins, Who Loses

The Winners: Those Who Already Have Everything

The bill extends and expands Trump-era tax cuts, with the most lucrative provisions designed specifically for the wealthy. The repeal of the Alternative Minimum Tax alone represents a massive giveaway to high-income households. Expanded pass-through deductions will primarily benefit business owners and real estate moguls—you know, the kind of people who've never had to choose between paying rent and buying groceries.

Here's what the data shows for annual income changes:

The Losers: Everyone Else

While the wealthy celebrate, working families and the most vulnerable Americans face devastating cuts:

SNAP (Food Assistance) Cuts: $267 billion slashed from a program serving over 42 million Americans. That's families like the ones in my neighborhood, where abuelitas stretch commodity cheese into miracles and kids depend on school breakfast because there might not be food at home.

Medicaid Devastation: Nearly $700 billion in cuts, with the CBO estimating 7.6 to 15 million people could lose health insurance. For communities like ours along the border, where healthcare access is already limited and environmental health hazards from decades of industrial pollution create higher rates of asthma, diabetes, and cancer, this isn't just policy—it's a death sentence.

The impact on low-income families is brutal:

The Historical Context: This Isn't New, It's Just Bigger

We need to zoom out to understand the magnitude of what just happened.

Since the 1970s, we've witnessed a systematic dismantling of the social safety net while wealth has concentrated at the top. However, this bill represents something qualitatively different—policy experts at the Center on Budget and Policy Priorities and the Center for American Progress are calling it the largest single legislative transfer of wealth from poor to rich in U.S. history.

It is as if they looked at the Gilded Age and thought, "You know what? We can do worse."

The Penn Wharton Budget Model projects that while the bottom 20% of earners will lose over $1,000 in after-tax income annually, the top 0.1% will gain nearly $390,000 per year. That's not economic policy—that's organized pillaging with a Congressional stamp of approval.

The Borderlands Perspective: Environmental Racism Meets Economic Violence

From where I sit in the Sonoran Desert, watching this unfold feels like déjà vu with a twist of chile and extra cruelty. Those of us living in frontline communities have always borne the brunt of extractive capitalism—from uranium mining on indigenous lands to maquiladoras poisoning our air and water to border militarization that treats our pueblos like war zones.

Now they're adding economic extraction to environmental extraction. The same communities that suffer the highest rates of pollution-related illness are losing healthcare access. The same families who work in agriculture, hospitality, and care work—keeping America fed, housed, and functioning—are losing food assistance.

¿Cómo se dice "adding insult to injury" in policy-speak? Oh right, "reconciliation."

The Politics of Cruelty: Why They're Doing This

House Minority Leader Hakeem Jeffries warned that passing this bill might cost Republicans their majority in the midterms. He's probably right—cutting taxes for the rich while slashing Medicaid is about as popular as a chupacabra at a livestock convention. So why are they doing it?

Because they're not governing for the next election—they're governing for the next century. They know their demographic and political power is waning, so they're using their temporary majority to lock in permanent changes to the social compact. It's the same strategy we've seen with gerrymandering, voter suppression, and court-packing: seize power, change the rules, maintain control.

The fact that they're pretending the bill won't do what it obviously does—imposing "work requirements" on Medicaid that are designed to kick people off the program through bureaucratic barriers—shows they know it's unpopular. But they're counting on their media apparatus to spin the narrative and their voters to blame Democrats, immigrants, or anyone except the people actually robbing them blind.

The Economic Consequences: Deficit Spending for Thee, Not for Me

Republicans spent the Obama years clutching their pearls about deficit spending, then exploded the deficit under Trump, and now they're about to do it again—but only for tax cuts that benefit their donors.

When it comes to investing in infrastructure, education, healthcare, or climate action, they suddenly become fiscal hawks. When it comes to giving billionaires another yacht, money is no object.

The timing makes this especially reckless. We're in the middle of an economic expansion with interest rates rising. Massive deficit spending right now—especially spending that doesn't boost economic demand or productivity—risks triggering a debt spiral in which higher deficits force higher interest rates, which create higher deficits ad infinitum.

With interest payments already approaching $1 trillion annually, we're basically borrowing money to give tax cuts to people who will park that money in offshore accounts instead of spending it in the real economy. It's the economic equivalent of setting your house on fire to keep your neighbor's mansion warm.

What This Means for You: Beyond the Numbers

If you're reading this and thinking, "Okay, but how does this actually affect my life?"—here's the real talk:

If you rely on SNAP: Get ready for more hoops to jump through, longer waits, and potentially losing benefits altogether. The "work requirements" aren't about encouraging employment—they're about creating bureaucratic barriers to kick people off the program.

If you depend on Medicaid: Start planning for the possibility of losing coverage. The cuts are scheduled to take effect after the 2026 midterms (qué conveniente), but the damage to state budgets and healthcare systems will start immediately.

If you're a working-class family: You'll pay higher taxes to subsidize tax cuts for millionaires while losing access to programs that help you afford food and healthcare. ¡Órale! What a deal.

If you care about climate change: Good luck getting federal investment in clean energy, environmental justice, or climate adaptation when all the money is going to tax cuts for fossil fuel executives.

Indigenous and Borderlands Communities: Double Jeopardy

For indigenous and Chicano communities, this hits differently. We're already dealing with the legacy of centuries of land theft, resource extraction, and environmental racism. Our communities have higher rates of poverty, limited healthcare access, and greater exposure to environmental toxins from mining, agriculture, and border infrastructure.

The cuts to Medicaid will disproportionately impact tribal communities and border pueblos where federal programs provide essential healthcare. The SNAP cuts will hit families in rural areas where grocery stores are scarce and food costs are high. Meanwhile, the tax cuts will flow to the same corporate interests that have been extracting wealth from our lands and labor for generations.

It's colonialism with a congressional stamp—taking resources from indigenous communities to benefit the colonizer class. Más de lo mismo, just with bigger numbers.

A Note of Hope: La Resistencia Continues

But here's what the architects of this theft don't understand: communities that have survived genocide, colonization, and displacement know how to survive economic violence, too. For centuries, we've been building networks of mutual aid, practicing solidarity economics, and creating alternatives to their extractive systems.

Every community garden in a food desert is resistance. Every mutual aid network helping families pay rent is resistance. Every vote cast against politicians who prioritize billionaires over babies is resistance. Every indigenous-led fight for water rights, every immigrant rights organization, every environmental justice campaign—that's the real "big, beautiful" movement that's growing stronger every day.

How to Get Involved: Building Power from the Grassroots

This fight isn't over. The bill still needs to pass the Senate, and that's where we can make our voices heard:

Contact Your Senators: Call, email, and visit their offices. Make it clear that voting for this wealth transfer will cost them your vote and your organizing energy.

Support Local Organizations: Find indigenous-led, immigrant rights, and environmental justice organizations in your area. They're doing the real work of building alternative economies and protecting frontline communities.

Register Voters: The best response to bad policy is more democracy. Register your neighbors, especially in communities that have been historically excluded from electoral participation.

Practice Mutual Aid: Build the world we want to see. Share resources, support each other, and create systems of care that don't depend on government programs they can cut.

Stay Informed: Subscribe to independent media sources like Three Sonorans Substack that center frontline voices and connect local struggles to national policy. We need media that tells the truth about what's happening in our communities and how to fight back.

Run for Office: Local elections matter. School boards, city councils, county supervisors—these positions shape daily life in our communities and create launching pads for state and federal change.

The people who passed this bill are counting on us to feel powerless and accept that this is just how things are. But those of us who come from the borderlands know that borders are just lines drawn by people who were never meant to contain our spirits. Their "beautiful bill" is built on the assumption that we'll stay divided and blame each other instead of them.

They're wrong.

La lucha sigue, and we're just getting started.

Support independent journalism that centers frontline voices. Subscribe to Three Sonorans Substack to stay informed about the intersections of indigenous rights, environmental justice, and immigration policy from a borderlands perspective.

What questions do you have about how this legislation affects your community? What forms of resistance and mutual aid are you seeing in your area? Leave a comment below—¡vamos a platicar!

Have a scoop or a story you want us to follow up on? Send us a message!

What a horror-show! Robert Reich spelled out the specifics: https://robertreich.substack.com/p/why-the-one-big-beautiful-bill-is?utm_source=post-email-title&publication_id=365422&post_id=164105750&utm_campaign=email-post-title&isFreemail=true&r=1mnl46&triedRedirect=true&utm_medium=email